You look up a 15-month bond forward contract and find the following. A US company has bought a machine worth 3 million euros from a German manufacturer with payment due in three months.

What Is A Forward Contract Corporate Finance Institute

The contract matures in 6 months and is for 10000 lbs.

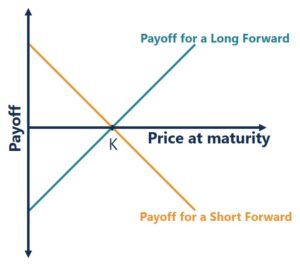

. Futures contracts are only traded over the counter. The seller of the contract is called the short. CDelivery or final cash settlement usually takes place with forward contracts.

DForward contracts usually have one specified delivery date. Each contract is unique to the terms of the contract. Forward contracts are not the same as.

The futures contract is usually physically delivered whereas the forward contract is not The counterparty to the futures participant is unknown with the clearinghouse stepping into each transaction whereas the. AFutures contracts nearly always last longer than forward contracts. Sell securities in the future.

A forward contract are standardized and trade on stock markets and exchanges. A forward contract is a contract whose terms are tailor-made ie. Forward contract dealers are often banks.

Which of the following is NOT true. Both deal in durable goods. A long contract requires that the investor.

Since the terms are set when it is executed a forward contract is not subject to price fluctuations. A futures contract is for a fixed maturity whereas the forward contract is for any maturity you like up to one year. This investing strategy is a bit more complex and may not be used by the everyday investor.

BFutures contracts are standardized. The buyer of the contract is called the long. The following exercise is designed to help students identify and interpret forward contracts in a real-life business context.

Consider the following example of a. Are settled through clearing houses thus removing credit risk. Forward contracts have no default risk.

Forward contracts are regulated by the Commodity Futures Trading Commission. Herein lies a big opportunity if you are a great salesperson. At a specific price on a specified date in the future.

Creates a right but not an obligation to do something in the future. Dealers offer long and short forward contracts at different prices. Negotiated between buyer and seller.

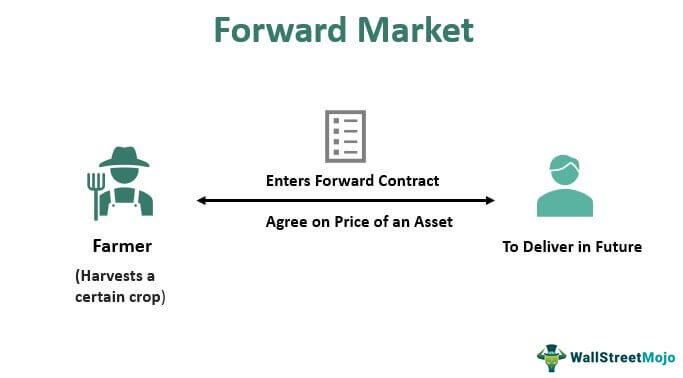

A forward contract is a customized contract between two parties to purchase or sell an underlying asset in time and at a price agreed today known as the forward price. Bens and CoffeeCo negotiate a forward contract that sets the price of coffee to 4lb. They are typically traded in the same financial markets and subject to the same rules and regulations.

In forward contracts products are not standardized. Both are used for hedging. All of the above.

The current price of the bond is 1200 and the forward price is 1300. Cancellation and re-booking of forward contracts is permitted freely to all other forward contracts of residents subject to following conditions. Commits the parties to the contract upfront to do something in the future.

Forward Contracts - A Practical Exercise. Forward contracts are marked to market daily. All of the above are true.

The buyer is betting that the price will go up. Both have the buyer taking future delivery of. Which of the following is INCORRECT.

Futures contracts require an initial margin requirement be paid. A forward contract is an agreement between two parties to buy or sell an asset at a specified price at a fixed date in the future. A forward contract often shortened to just forward is a contract agreement to buy or sell an asset Asset Class An asset class is a group of similar investment vehicles.

Regardless of whether cyclones destroy CoffeeCos plantations or not Ben is now legally obligated to buy 10000 lbs of coffee at 4lb total of 40000 and CoffeeCo is obligated to. It is a contract in which two parties trade in the underlying asset at an agreed price at a certain time in future. Which of the following statements regarding forward contract dealers is NOT correct.

The treasurer finds that DeutscheUSA a fictitious name a large commercial bank bids euros for 15000 and. 4 Listen Which of the following is NOT true regarding the difference between a currency futures contract and a forward contract. It is not exactly same as a futures contract which is a standardized form of the forward contract.

That means if two parties agree to. Forward contract buyers and sellers do not know who the counterparty is. It will pay a.

Total forward contracts covering importnon-trade transactions re-booked shall not exceed the total of the. For example a buyer and seller can negotiate a forward contract of potatoes for a quantity of 2 tons while someone else might negotiate another contract for 20 tons. Dealers are compensated through up-front.

Futures contracts trade on organized exchanges whereas forwards take place between individuals and banks with other banks via telecom linkages. Forward contracts are not. Both require estimates of the future by participants.

Ex-Im banks purpose is to provide financing in situations where private financial institutions are unable or unwilling to because of which of the following reasonsi The loan maturity is too longii The amount of the loan is too largeiii The loan risk is too greativ The importing firm has difficulty obtaining hard currency for paymentv There are no futures or forward contracts. The same is not true of futures contracts. Forward contracts do not trade on a centralized exchange and are considered over-the-counter OTC instruments.

Which of the following is not common to both forward contracts and futures contracts.

0 Comments